Introduction

If you are receiving transfers through Fast Payments (via Osko®), also referred to as the New Payments Platform (NPP), your incoming payments could be rejected if you’re providing your Member Number as part of your banking details.

To ensure incoming Fast Payments make it into your account, it’s important to provide the right electronic payment details such as a BSB and Account Number or valid PayID instead.

What is the difference between my Member Number and Account Number?

Your Member Number is the number associated with your Membership. It is a 7-digit number starting with ‘5’. Usually, you will only have (1) one Member Number. Often, you’ll see your Member Number followed by a letter and number like ‘S1’ or ‘L30’ which represents the type of account or loan you have e.g., 5912345S1. Your Member number is used to:

- Identify your membership in branch or over the phone

- Log in to Online Banking

- Register for the Banking App.

Your Account Number is unique to each banking account or loan you have with us. It is a 9-digit number starting with ’10’ e.g., 100208528. If you have multiple accounts and loans with us, you will have multiple Account Numbers. Your Account Numbers are used to:

- Identify individual accounts

- Transfer funds into specific accounts.

For example:

Poccu has one Police Credit Union Member Number 5912345 which he uses to log into Online Banking and to identify himself in branch. Under his membership he has one loan with the Account Number 100208528 and one savings account with the Account Number 1000039268. When transferring money online or providing his banking details, Poccu uses the Account Numbers to make sure the money goes into the correct accounts.

When would I use my Account Number instead of my Member Number?

Your Account Number is really handy to make sure money is transferred into a specific account. It’s especially important for external payees and transfers from other financial institutions, particularly when using Fast Payments. Whereas using a Member Number to transfer funds will mean the payment will go into one of the accounts under your membership (often a default account) or will be rejected as the system cannot determine the exact account for payment.

What electronic transfer details should I provide?

To ensure your payments DO NOT get rejected and to ensure the money is paid into your desired account, you should provide future payment senders with your:

- Account Name (usually your name)

- BSB (805-005)

- Account Number (not your Member Number – see details below on how to find your Account Number)

Where can I find my Account Number?

You can view your individual Account Number on your Statements, in Online Banking and the Banking App.

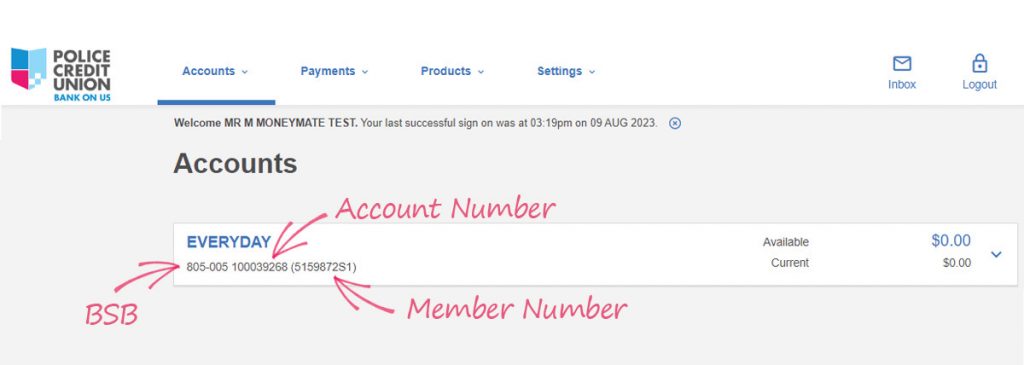

Online Banking

You can view your Account Number in Online Banking on the ‘Home Page‘ and when you return to the ‘Accounts’ page from another menu. Under each account name you’ll find the BSB (805-005), the individual Account Number, and your Member Number.

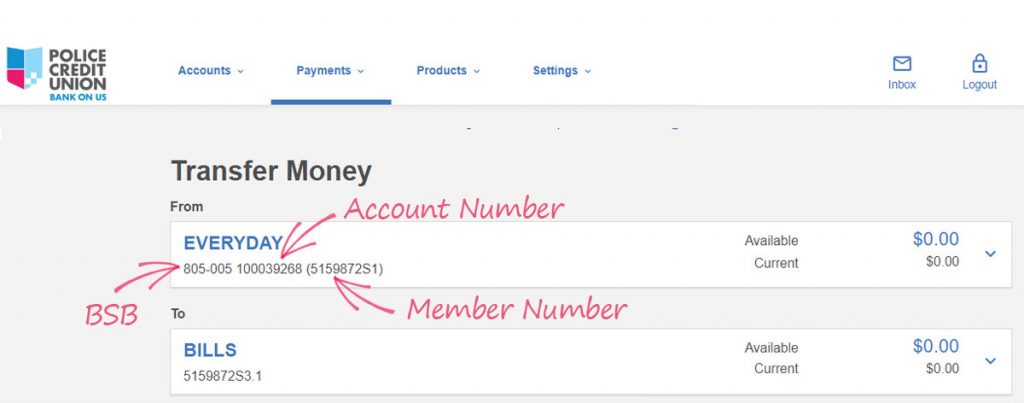

You can also see the Account Number when you transfer funds, head to ‘Payments‘ and select ‘Transfer Money‘. When you select an account to transfer from, you’ll see your BSB number (805-005), the individual Account Number, and then your Member Number.

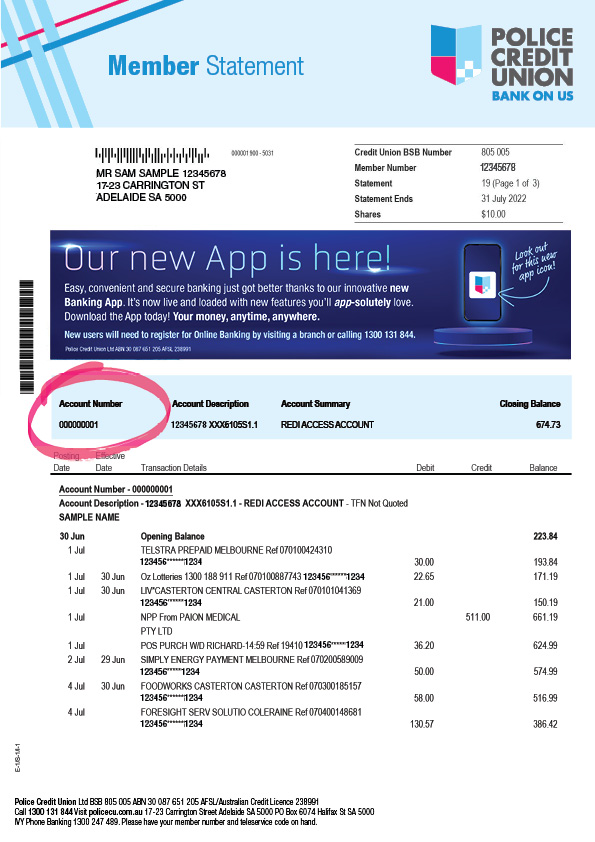

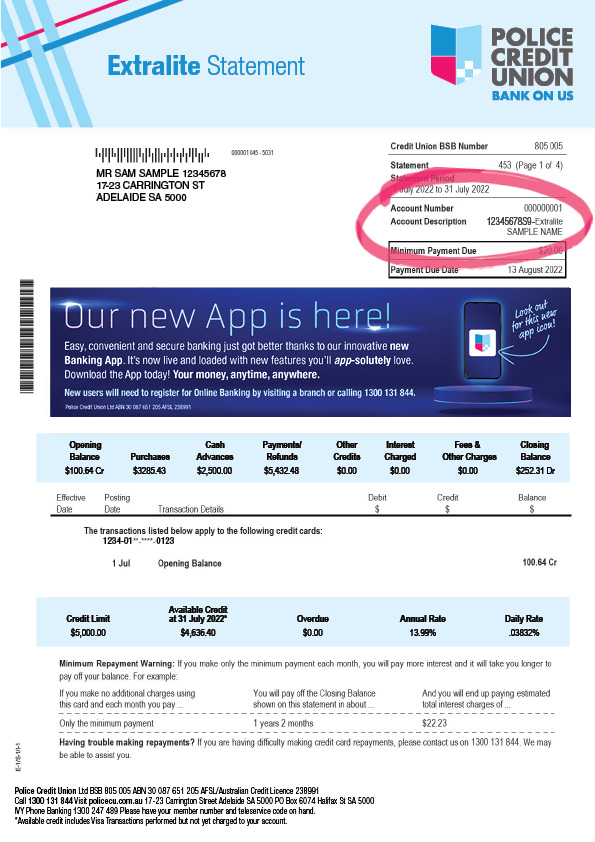

Statements

You can view your Account Numbers on your monthly statements on the first page listed under Account Number (circled in image below).

Transferring funds made easy. That’s better banking! If you’d like to learn how to receive payments using an email address or phone number, read about PayID.